The digital gold rush is upon us, and at the heart of this modern-day prospecting lies the humble, yet powerful, mining rig. Forget picks and shovels; today’s miners wield sophisticated hardware churning through complex algorithms, chasing the elusive promise of cryptocurrency rewards. But stepping into this world, particularly the world of wholesale mining rigs, requires a savvy understanding of the landscape. It’s not just about plugging in and hoping for the best; it’s a strategic game of hardware, electricity costs, and market fluctuations.

The allure is undeniable: the potential to generate passive income, the thrill of contributing to a decentralized network, and the futuristic appeal of harnessing computational power for financial gain. Bitcoin, the undisputed king of crypto, ignited this fire, but the ecosystem has since exploded with a diverse array of digital assets, each with its own unique mining algorithm and profitability potential. Ethereum, with its shift towards Proof-of-Stake, has reshaped the mining landscape, pushing miners towards alternative coins and innovative mining strategies. Even meme coins like Dogecoin, fueled by community enthusiasm and viral trends, have carved out a niche in the mining world. The diversity is staggering, demanding constant adaptation and vigilance.

Navigating the wholesale market requires a sharp eye for quality and a deep understanding of your specific mining goals. What cryptocurrency are you targeting? What is your budget? What are your electricity costs? These are crucial questions that must be answered before investing in bulk mining rigs. Different cryptocurrencies demand different hardware configurations. Bitcoin mining, for example, is dominated by specialized ASICs (Application-Specific Integrated Circuits) designed solely for the SHA-256 algorithm. Other cryptocurrencies, like Ethereum Classic or Ravencoin, might be better suited for GPU-based mining rigs.

The choice of hardware is just the first piece of the puzzle. Power consumption is a critical factor that can significantly impact your profitability. High-powered rigs generate a lot of heat and consume a significant amount of electricity. If your electricity costs are too high, you could end up spending more on energy than you earn in cryptocurrency. Optimizing power consumption is therefore essential, and this often involves tweaking settings, undervolting GPUs, and implementing efficient cooling solutions.

And speaking of cooling, proper ventilation and temperature control are paramount. Overheating can lead to hardware failure, reduced performance, and even fire hazards. Mining farms, particularly those housing numerous rigs, require sophisticated cooling systems to maintain optimal operating temperatures. Immersion cooling, a technology where mining rigs are submerged in a dielectric fluid, is gaining popularity as a highly efficient and effective cooling solution.

But the hardware is only half the battle. Successful mining also requires a strategic approach to pool selection and payout optimization. Mining pools aggregate the computational power of numerous miners, increasing the chances of finding a block and earning rewards. Different pools offer different payout structures, fees, and levels of reliability. Choosing the right pool can significantly impact your overall profitability. Similarly, optimizing your payout settings, such as the minimum payout threshold and the transaction fee, can help you maximize your earnings.

Beyond individual rigs, the rise of mining farms has transformed the landscape. These large-scale operations house hundreds or even thousands of mining rigs, leveraging economies of scale to maximize profitability. Mining farms often have access to cheaper electricity, more sophisticated cooling systems, and dedicated maintenance teams. However, setting up and managing a mining farm requires significant capital investment and technical expertise. For many, hosting their mining rigs at a dedicated hosting facility is a more attractive option. Hosting facilities provide the infrastructure, security, and technical support necessary to keep your rigs running smoothly, allowing you to focus on the strategic aspects of mining.

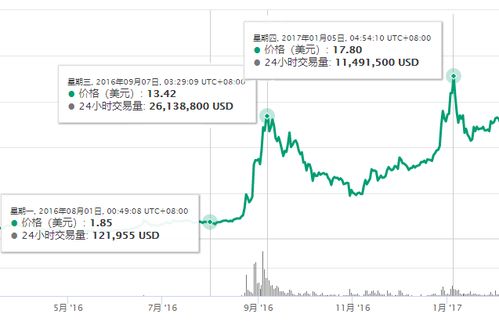

The cryptocurrency market is notoriously volatile, and mining profitability can fluctuate dramatically. Factors such as the price of the cryptocurrency, the difficulty of the mining algorithm, and the overall hash rate of the network can all impact your earnings. Staying informed about market trends, monitoring network conditions, and adapting your mining strategy accordingly is crucial for long-term success. Diversifying your mining portfolio by mining multiple cryptocurrencies can also help mitigate risk.

Furthermore, understanding the regulatory landscape is essential. Cryptocurrency regulations are still evolving in many jurisdictions, and it’s important to be aware of the legal and tax implications of mining. Compliance with local regulations is crucial to avoid potential legal issues and ensure the long-term sustainability of your mining operation. The legal status of Bitcoin, Ethereum, and other cryptocurrencies varies widely from country to country, requiring diligent research and potentially consultation with legal professionals.

Ultimately, the world of wholesale mining rigs is a dynamic and challenging, but potentially rewarding, endeavor. It requires a combination of technical expertise, financial acumen, and a willingness to adapt to the ever-changing landscape of the cryptocurrency market. By understanding the intricacies of hardware selection, power optimization, pool selection, and market dynamics, you can position yourself for success in this exciting and evolving industry.

A white-knuckle ride into crypto-mining profitability. Explores rig optimization beyond hardware, revealing unexpected power-saving tactics and profit-boosting strategies. A must-read for serious miners.